-

Sustainable supply chain management in Thai leather and food industry

EU will announce a regulation to bar agricultural products that are illegal and produced on deforested land from the EU market. It sets to regulate timber, cocoa, coffee, soy, cattle, palm oil, and rubber and will be applied to products in the EU and imported. Operators will need to conduct due diligence before placing any of these products on the EU market. /*! elementor - v3.6.2 - 04-04-2022 */ .elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} As an agricultural country, Thailand is alerted by this new EU regulation. Recently, on 14 Dec., Prime Minister Prayut Chan-o-cha urged all relevant agencies to follow up on any development closely. In this article, TEFSO talked with representatives from the leather and the food industry to discuss their views on EU regulation and their sustainable supply chain management. With high export volume to the EU, leather industry is familiar with sustainable supply chain management and is not concerned about the new EU regulation There are three main groups of leather export; leather for shoes, automotive and furniture. ‘My company supplies leather to major brands like Nike and Adidas; other members of our group supply to the automotive industry like Mercedes, Toyota and Honda.’ – representative of Leather Industrial Group, Federation of Thai Industries said. Export of cocoa, coffee and corn to the EU are low to non-existent, but the group has some concerns in case the EU expands the product scope ‘For now, deforestation-free regulation might not impact much because Thailand has never exported beef or pork to the EU. There’s some export of coffee but in a minimal quantity. So does cocoa which is not Thailand’s agricultural produce though there has been some initiative to promote it. We still have some concerns in case the EU expands the product scope in the future.’ – representative of Food Industrial Group, Federation of Thai Industries said. Sustainable supply chain management is nothing new for the leather or food industry The Leather Industrial Group and the Food Industrial Group confirmed their familiarity with sustainable supply chain control. Overall, the leather industry is ready for EU regulation because, for a long time, they have had a certification system to comply with major brands from the US and EU. ‘In 2017, our customers; Nike, Timberland and Adidas launched a Global Policy to take only traceable leather certified by recognized third party auditors. These major brands only allow tanneries to use leather from certified farms. There’s a certification system like the Leather Working Group. As an estimation, I’d say 30% of leather producers in Thailand are certified.’ ‘In food industry, there’s Good Agricultural Practices (GAP) managed by the Ministry of Agriculture and Cooperatives. GAP verifies legal and sustainable agricultural production. For most products, GAP is voluntary; only five are required.’ Concern over small-scale operators who do not have capacity to get certified ‘In food supply chain, there’re still many uncertified small-scale farmers. Without certification, they might have difficulties proving that their production is sustainable. Big companies like CPF and Betagro have stepped in to help farmers in their networks to get certified, but there’s still a lack of government support.’ ‘GAP has existed for more than ten years. If then the government had supported farmers to get certified, farmers would be readied for the EU regulation by now and would not have to wait for help from big companies.’

Continue reading -

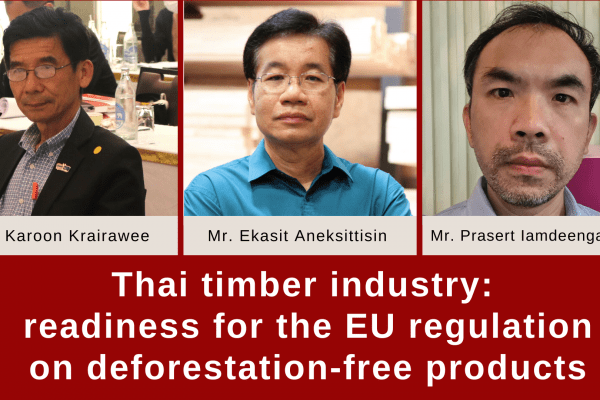

Thai timber industry: readiness for the EU regulation on deforestation-free products

As the EU regulation on deforestation-free products is underway, how does the Thai timber industry view its impacts and challenges? Find out in this article as we sat down with representatives from the Thai Timber Association and the Sawmill Association. When mentioning products at risk of deforestation, timber is undoubtedly the first product that comes to mind. Thus, wood trading has always been under scrutiny and rigorous control. However, studies have now shown that timber is not the only industry at risk of contributing to deforestation, but also agricultural and cattle products. This paradigm shift led to the new EU regulation on deforestation-free products. The regulation will impose control on timber and agricultural commodities at risk of deforestation, mandating due diligence before selling in or exporting from the EU market. Once the EU announced its plan, parties worldwide came out to channel their opinions; some see it as too restricted, fearing burdens on operators, while others see it as too relaxing. In this article, we sat down with members of the Thai Timber Association and the Timber Processing Industry Group from the Federation of Thai Industries to talk readiness of the Thai timber industry for the regulation on deforestation-free products and possible impacts on other commodities.Operators are confident of the industry’s readiness It is believed that the timber industry is more well-equipped than other sectors because forest management, legality, and supply chain control have always been the standard practices of the timber sector. Moreover, the industry is used to controls and regulations by the European Timber Regulation from the EU and other countries.Mr. Prasert Iamdeengamlert, Sawmill Association: ‘As a timber operator, I do not see that the new regulation is much different from the European Timber Regulation since both are based on Due Diligence, which the timber industry is familiar with.’Mr. Ekasit Aneksittisin, Thai Timber Association: ‘I am not too worried, but of course, more documents need to be processed.’Most importantly, Thailand should prepare for a valid land deed system, a vital document to prove deforestation-free Since the regulation stresses that products must be able to confirm their deforestation-free origin, operators see that Thailand should prepare a valid land deed system to prove that commodities are produced on deforestation-free land; the document should be able to demonstrate the date of allocation to show compliance with the EU cut-off date.Divergence of legal definitions of “forest” and “forest degradation” between the EU and producing countries is a cause of concern, also the challenge in proving deforestation-freeMr. Iamdeengamlert: ‘Different interpretation of the term “forest” which depends on the countries’ contexts poses a challenge; also, to verify deforestation or not, I expect further discussions on these.’Concerns looming over other products outside the timber industry that may not be familiar with Due DiligenceFor a long time, timber products have always been strictly regulated. Thus, timber operators are aware of what to do. But concerns are shared over other commodities as this might be the first time they will be subjected to tighter control. Above all, attention is given to smallholders in those products and their capacity to control the supply chain. It is seen that some commodities in Thailand are produced on lands at risk of deforestation.Mr. Krairawee: ‘Deforestation-free products will affect important Thai exports. I believe that some of them are still produced on land at risk of deforestation. Moreover, many of them are smallholders.’ Thai government should take a lead role, and the timber industry is ready to supportAll agreed that the government should take a lead role; all relevant agencies should get involved and promote it with stakeholders.

Continue reading